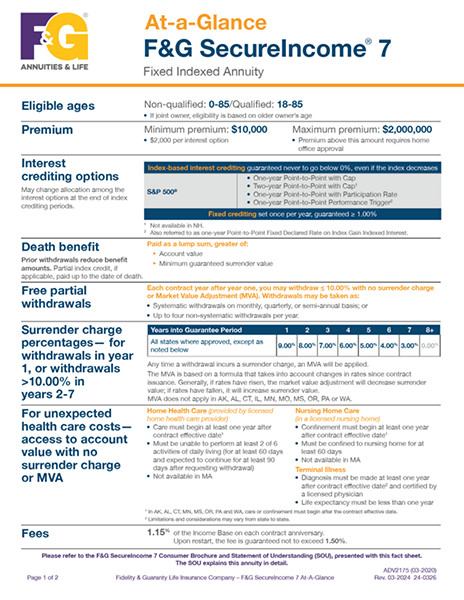

F&G SecureIncome 7

Flexible Premium, Deferred, Fixed Indexed Annuity for Future Income

Guaranteed income that you can't outlive in retirement

- A more predictable way to build your income base

- Double the payment amount if you become impaired

- Tax deferred savings1

- Access for those unexpected health care expenses when you need it most

- The ability to maintain control over your annuity saving (payments without annuitization)

Download Materials

F&G SecureIncome Brochure

Download our consumer brochure. To order hardcopies, please visit SalesLink

At-a-Glance

Download our product features guide. To order hardcopies, please visit SalesLink

For financial professional use only. Not for use with the general public.

1 Information provided regarding tax or estate planning should not be considered tax or legal advice. Consult your own tax professional or attorney regarding your unique situation.

“F&G” is the marketing name for Fidelity & Guaranty Life Insurance Company issuing insurance in the United States outside of New York. Life insurance and annuities issued by Fidelity & Guaranty Life Insurance Company, Des Moines, IA.

This product is a deferred, fixed indexed annuity that provides a minimum guaranteed surrender value. You should understand how the minimum guaranteed surrender value is determined before purchasing an annuity contract. Even though contract values may be affected by external indexes, the annuity is not an investment in the stock market and does not participate in any stock, bond or equity investments.

The provisions, riders and optional additional features of this product have limitations and restrictions, may have additional charges and may not be available in all states.