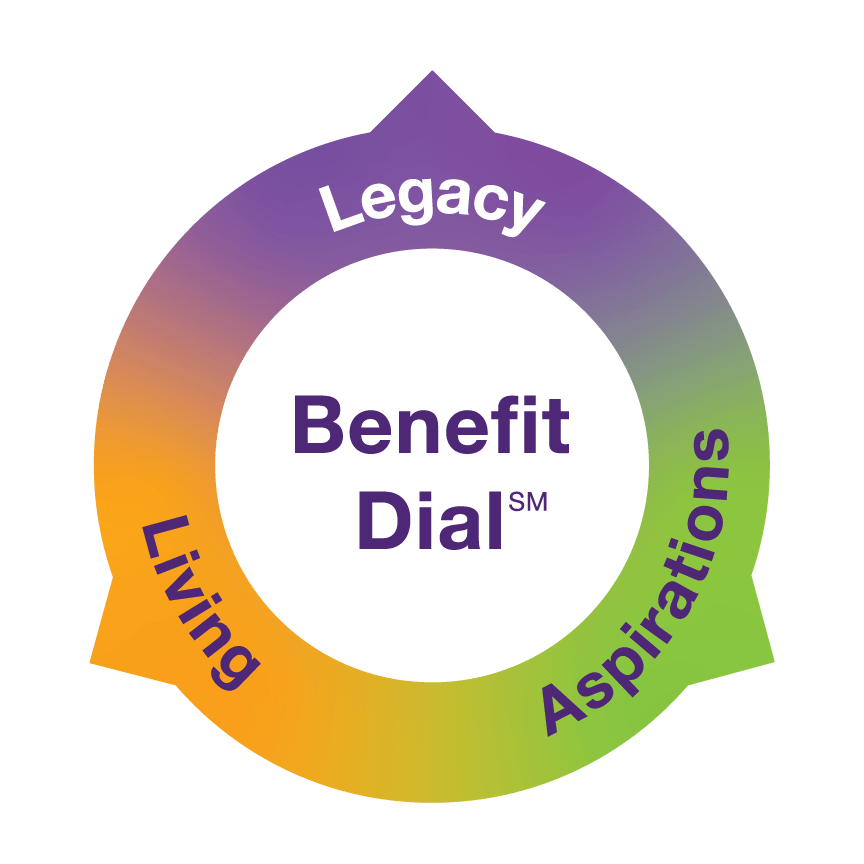

Spin the DialClick on the different dial options to discover more about each.

LegacyProtect your family – IUL can help your dreams for your family become a reality even after you’re gone.

LegacyPay off your mortgage – IUL proceeds can help pay off your mortgage so your family is able to stay in your family home after you’re gone.

LegacyProtect your spouse – IUL can protect your spouse who’s relying on your income to live the life you’ve dreamed of building together.

LegacyProtect your child – IUL can protect your child in two ways – by protecting them in case you’re gone or by protecting them directly with a policy of their own that can be used to help pay for college and stay with them for life if they choose to continue payments.

AspirationsSee the world – Additional tax-efficient savings in an IUL can help make your aspirations a reality. Travel, explore, go on adventures – whatever your dreams look like.

AspirationsSpoil the grandkids – Additional tax-efficient savings in an IUL can help make your aspirations a reality. Visit the kids and grandkids, spend quality time with them, and maybe even spoil them a little.

AspirationsRelax in retirement – Additional tax-efficient savings in an IUL can help make your aspirations a reality. Whether poolside at home, in a hammock in the woods or kicked back in your recliner, make the most of leisurely days you’ve worked hard to earn.

AspirationsPay for college – IUL can be used to pay for college or other big purchases. Through policy loans, you’re not limited in how you spend the money you borrow against your cash value. Help pay for a wedding, buy a vacation home or that fancy sports car you’ve always wanted. The possibilities are endless.

LivingHelp with chronic illness – IUL lets you tap into your death benefit while you’re living in the event of a qualifying chronic illness or impairment that impacts two of six activities of daily living. Among many other conditions, this covers cognitive impairment such as Alzheimer’s disease and other forms of dementia.

LivingHelp with terminal illness – IUL lets you tap into your death benefit while you’re living in the event of a qualifying terminal illness. If life expectancy is under 24 months, you can immediately access up to 100% of your death benefit.

LivingHelp with critical illness – IUL lets you tap into your death benefit while you’re living in the event of a qualifying critical illness. Access up to 100% of your policy's death benefit for conditions such as heart attack, stroke, cancer, an organ transplant, amyotrophic lateral sclerosis (ALS), aka Lou Gehrig’s disease, and more.

LivingHelp with medical bills or anything else – In times of crisis, having access to additional money from an IUL can help you focus on your health and the people that matter most to you. Even better, those funds are yours to use however you see fit – to help with medical bills, in-home care, therapy – or simply enjoying time with your friends and family.